We are passionate, forward thinking entrepreneurs. We are driven to see our clients succeed. Everything we do, we believe we make a difference. We help clients turn their dreams and vision into reality.

When our clients

succeed, we succeed.

BST offers a broad portfolio of accounting and auditing, tax, consulting and wealth management services, as well as valuation, forensic accounting and litigation support.

BST’s expertise spans a range of industry niches, including real estate, construction, manufacturing and distribution, employee benefits, retail, medical and professional services, not-for-profit and government.

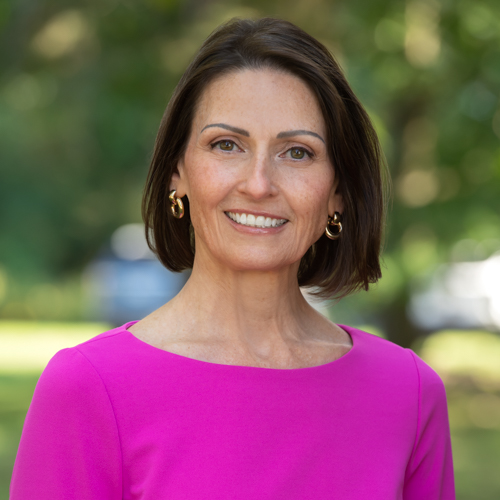

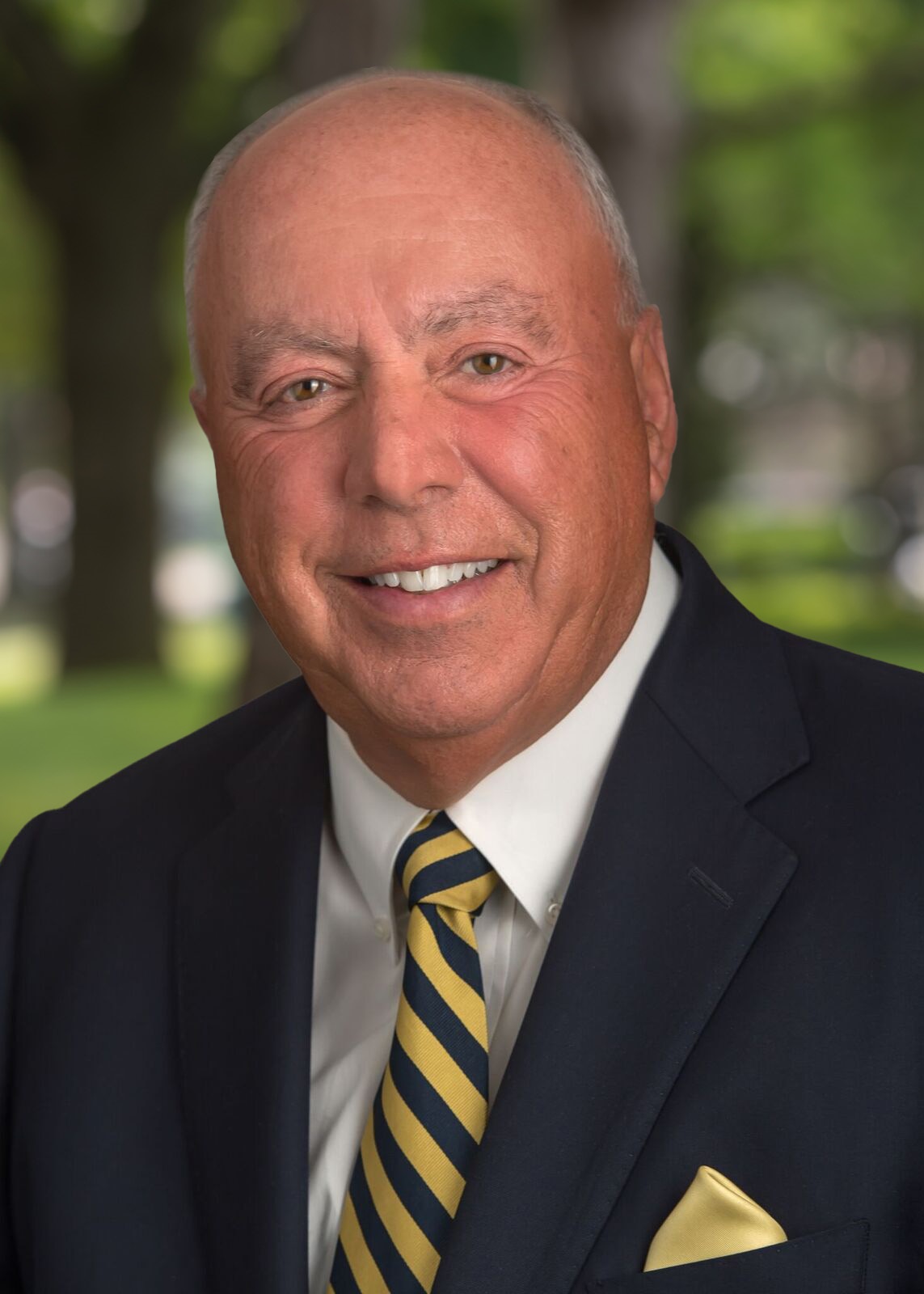

Meet the Team

Diversity of Expertise

We partner with you to take the pressure off and deliver the most responsive, advanced, and innovative solutions.

News

Collaborative and Service Driven from Day One

We build relationships, become trusted advisors and provide continuous consulting at every step of your journey.